Federal Compensation

Understanding the Full Value Beyond Base Salary

When considering a federal job offer, it’s crucial to evaluate the full value of your compensation package, which goes far beyond your base salary. Federal employees receive a wide range of benefits, from retirement plans and health insurance to transit subsidies and life insurance, which significantly enhance the overall value of the offer. Before diving into these benefits, let’s first clarify the difference between base pay and basic pay, as many benefits are calculated as a percentage of your basic pay.

Base Pay vs. Basic Pay

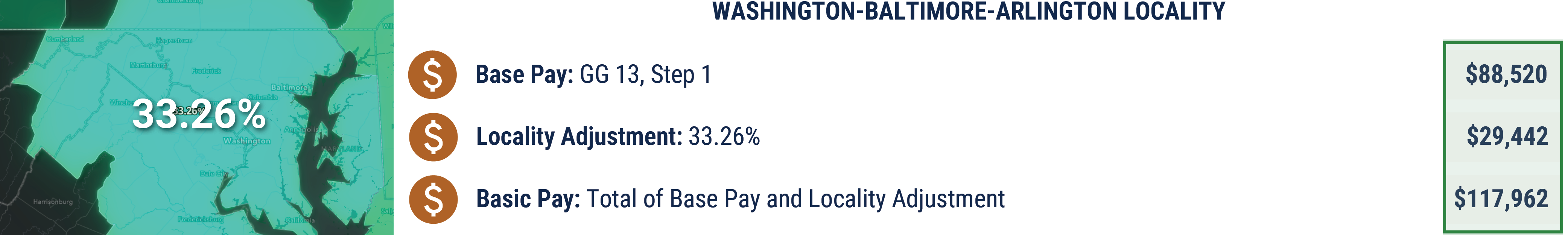

- Base Pay: Refers to the fixed amount of compensation an employee receives before any adjustments or benefits are added. It’s the raw salary without locality adjustments.

- Locality Adjustment: A pay locality adjustment is a percentage-based increase to a federal employee’s base pay that accounts for the cost of living in their geographic area.

- Basic Pay: A more comprehensive figure that includes both the base pay and a locality adjustment based on your location.

For example, consider a GG-13, Step 1 position in the Washington-Baltimore-Arlington locality:

Now that you understand the difference, let’s explore how this basic pay contributes to other incentives and benefits.

Federal Employees Retirement System (FERS)

FERS is a key component of your federal benefits package, providing retirement income from three sources:

- Basic Benefit Plan (FERS Pension): A traditional pension where both the government and employee contribute. The government covers the bulk of the cost, though contribution rates vary based on your hiring date.

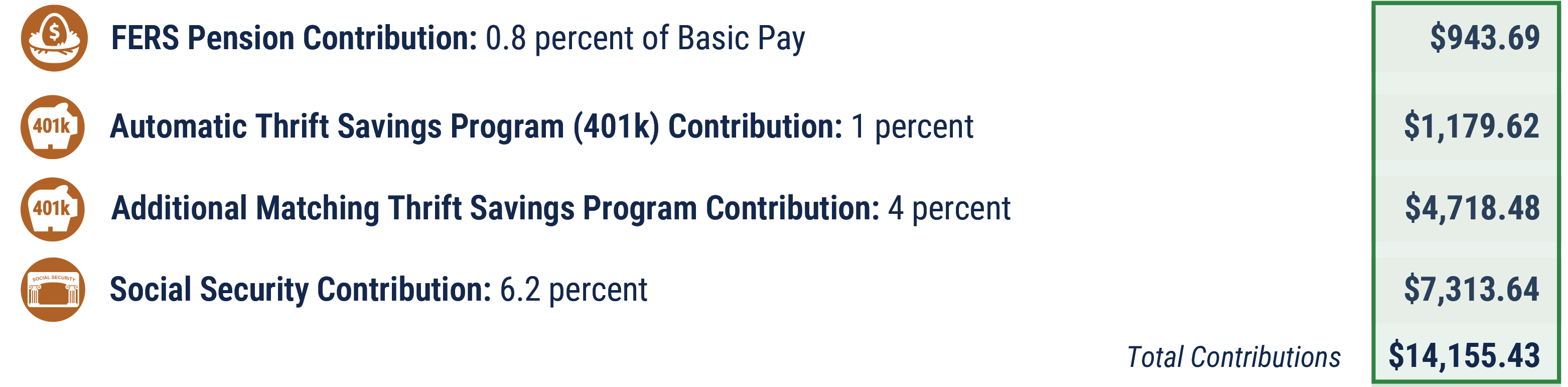

- Social Security: Like private-sector employees, federal employees contribute 6.2% of their earnings to Social Security, with the government matching this contribution.

- Thrift Savings Plan (TSP): Similar to a 401(k), the government contributes 1% of your basic pay to your TSP and matches up to 4% of your own contributions. In total, the government can contribute up to 5% of your basic pay.

Using our GG-13, Step 1 example, here’s a breakdown of federal contributions:

Federal Health Insurance (FEHB)

Federal employees, retirees and their survivors have a wide selection of plans to chose from — Consumer-Driven and High Deductible plans that offer catastrophic risk protection with higher deductibles, health savings/reimbursable accounts and lower premiums, or Fee-for-Service (FFS) plans, and their Preferred Provider Organizations (PPO), or Health Maintenance Organizations (HMO) if you live (or sometimes if you work) within the area serviced by the plan.

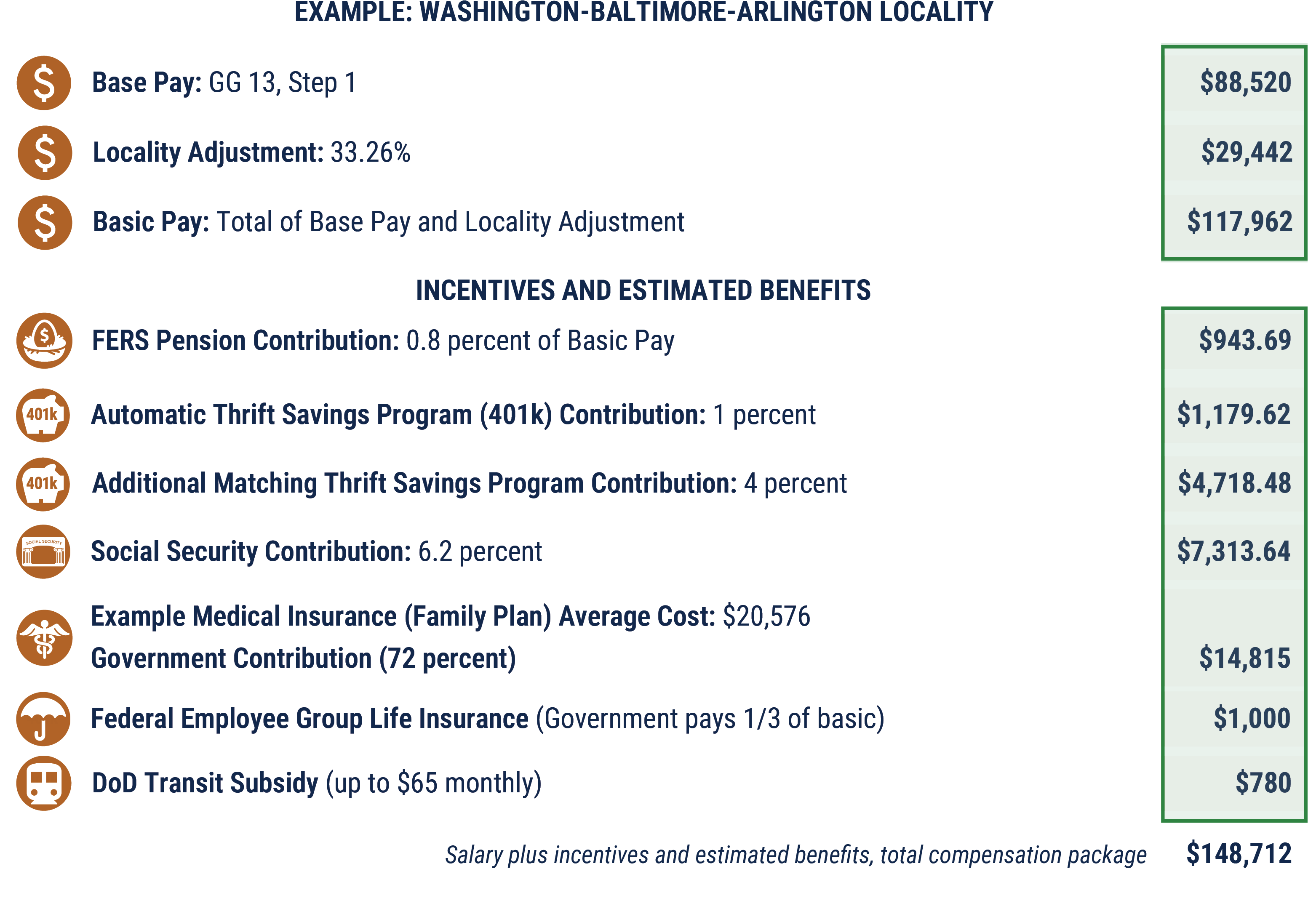

The Federal Employees Health Benefits (FEHB) program covers, on average, 72% of your health insurance premiums. The actual contribution depends on the plan and coverage level you select.

Federal Employee Group Life Insurance (FEGLI)

The cost of Basic insurance is shared between you and the Government. You pay 2/3 of the total cost and the Government pays 1/3. Your age does not affect the cost of Basic insurance. You pay the full cost of Optional insurance, and the cost depends on your age.

Transit Subsidy

The federal government may contribute to your commuting costs. For instance, the Department of Defense currently offers a transit subsidy of $65 per month, totaling $780 per year.

Total Real Value of Compensation

Let’s put it all together, using the GG-13, Step 1 example:

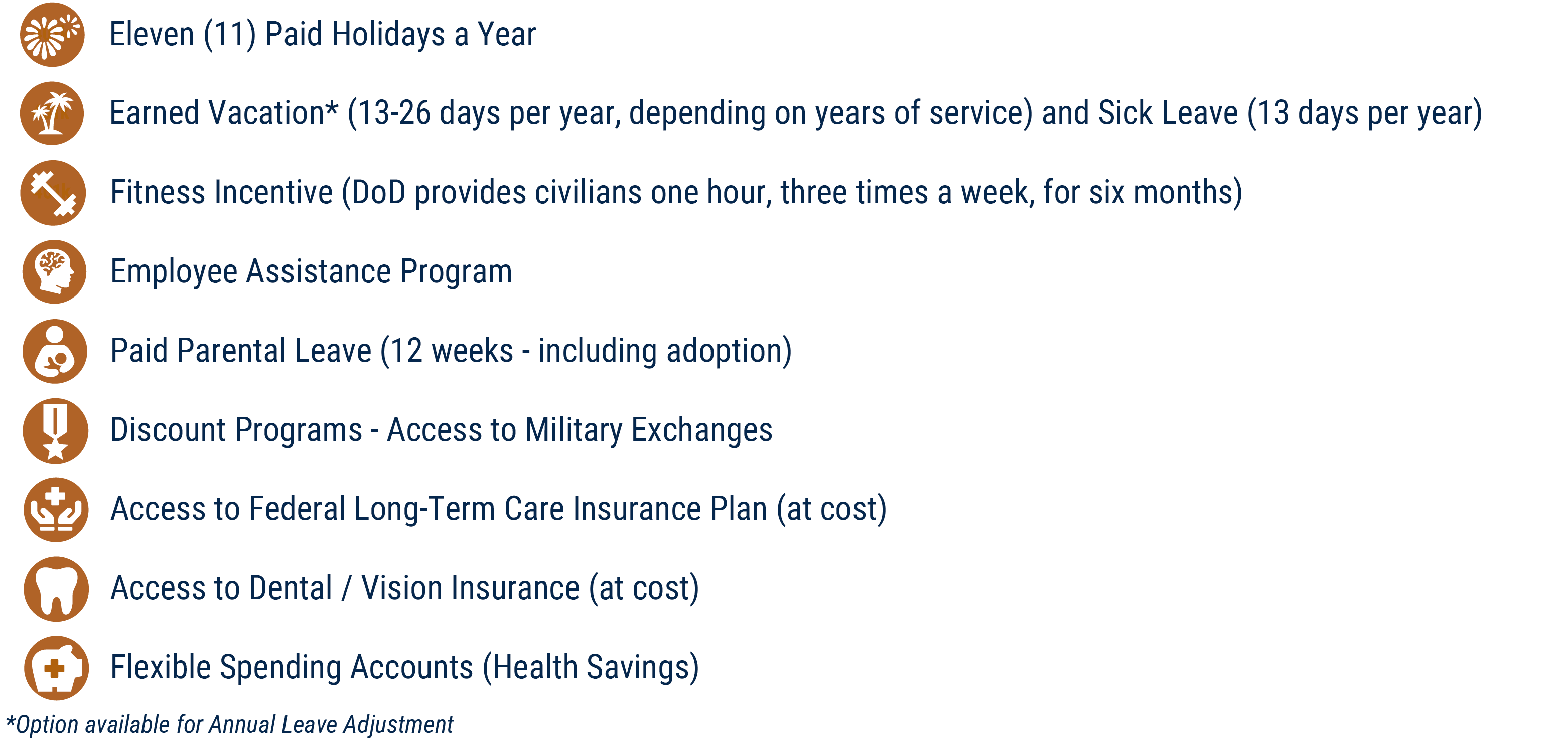

Employee Leave and Program Access

Beyond the monetary benefits, federal employment offers many other advantages and access to programs:

Additional Federal Benefits

Federal employment offers many other advantages that enhance both your professional growth and personal life:

- Career Advancement:

- Clear promotion pathways

- Career ladder positions offering faster promotions

- Job Security:

- Strong employment protections

- Opportunities for internal transfers and reassignments

- Work-Life Balance:

- Flexible work schedules (in many positions)

- Telework options (where applicable)

- Professional Development:

- Access to training and educational programs

- Potential for student loan repayment programs

- Public Service Loan Forgiveness (PSLF):

Federal employees may qualify for loan forgiveness through the PSLF program after 10 years of service and qualifying payments.

Evaluating the Full Picture

When assessing a federal job offer, it’s essential to look beyond the base salary and consider the full compensation package. The combination of competitive pay, comprehensive retirement benefits, health insurance, and additional perks like life insurance, transit subsidies, and generous leave policies makes federal employment highly attractive. While the base salary is significant, the real value comes from the long-term financial security, work-life balance, and career stability that federal employment offers.